A guest post by Kenosha’s 8th District Alderman Dave Mau.

Kenosha, let’s get our spending and debt under control, to properly and responsibly fund our first responders.

In May of this year, I received my first council meeting agenda as a new alderman. I was surprised to see a proposal for a referendum to raise our taxes.1 The amount a city can tax (levy) has a limit set by the State, and Kenosha has reached that limit. The only way the State allows them to tax us more is by passing a public vote. So on August 9th at the polls, Kenosha citizens will be asked to vote on raising taxes to pay for 10 police and 6 firefighters.

I strongly support our officers and firefighters and believe they need to be well funded. A central tenet of our government is to protect our rights, which includes the right to be free and safe, and I believe it to be a proper and moral use of taxpayer money. Knocking doors during my campaign, the vast majority of residents told me safety was their number one concern. So I think it’s imperative to allocate the City’s budget to move towards that assurance.

However, prioritizing funds is not the same as raising taxes, which my constituents are against. The City needs to fix its debt and development problem in order to free up funds. I also believe the way this proposal is being presented to the public is misleading and unethical. I ultimately voted “No” for the referendum, which passed 16-1.

Portrayal

According to the official city press release, “A failure to pass the public safety referendum to increase the levy will result in the City’s inability to hire the additional staff to meet the growing public safety needs of the community.” It essentially presents a false binary choice: either raise taxes, or you won’t be safe. Some might say that it has a hint of leveraging fear. But moreover, it’s misleading by omitting the other options, namely balancing the budget or limiting the duration of the tax increase.

Being new, and due to the way this proposal was brought to council, I had almost no time to talk it over with constituents or other alderpersons.2 So during the council meeting, I questioned if we could limit the duration of the tax increase, in order to provide time to get our budget back on track. The State statute allows either 1 year of increased taxes, or continuous. It was said that limiting the duration would result in officers being laid off after 1 year. I simply contend that wouldn’t happen if the budget was balanced. Point being, other options exist but are not being discussed with the public.

In addition, this referendum has often been portrayed as necessary due to the growth of Kenosha. I believe this is deceptive because the population has stayed close to 100,000 for a dozen years. Instead, the growth we are seeing is often due to development, requiring more city services and resources, and spreading the City limits outward. “Increased development in the City of Kenosha means the City needs additional public safety personnel,” said Mayor John Antaramian. In the past few decades, I believe the City has overcommitted resources to development and hasn’t properly budgeted for imperative spending. The development is often fabricated, wouldn’t exist without government influence, and creates debt. In my opinion, a debt per capita increase is not growth.

Debt

Regardless of a levy limit, we still have to prioritize. It’s not just a numbers issue, it’s a priority issue. There’s a good reason the State sets limits on how much cities can tax their citizens. It seems unfathomable to me that we’ve spent so much that we can no longer provide the most basic and essential needs like public safety. Many citizens who have ever struggled to maintain a household budget know that prioritizing is always possible and many times a requirement. I believe it’s never too late to stop the wild spending that has gotten the City here in the first place.

Imagine this scenario: A man exceeds his budget through frivolous spending on unnecessary luxuries. His roommate bails him out by agreeing to pay more of the rent from now on. This, of course, merely enables the man to continue his excessive spending because now he has extra money for his necessities. So even if the City uses the money for public safety, it can still continue its original wild spending habits elsewhere.

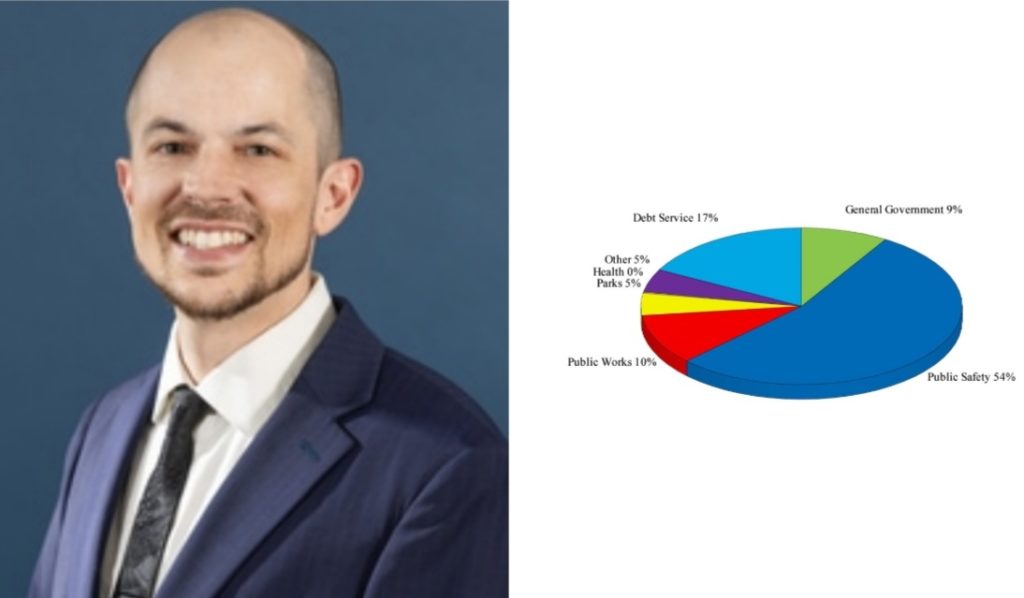

The City is currently in $225 million of debt, and accumulating $25 million in interest, which calculates to a shocking 11% in interest paid over the next 10 years.3 The debt is partially paid back each year, taking funds from the Operating Budget. A whopping 17% of the budget goes towards debt repayment.4 By State law, employees cannot be paid with credit, so police and firefighters must be paid by a budget that is 17% depleted from the get-go. That strain can be reduced if we re-prioritize.5

We’ve spent millions of dollars for 3 museums and 5 libraries with low turnout and six-figure salaries. Millions spent on special interests like the Boys & Girls Club, the bus barn, the Trolley, an archery range proposal, etc. This year alone, the City will create debt to the tune of nearly $1.5 million on the Libraries, $1.65 million to the Redevelopment Authority, $2.1 million to Transit, $1.2 million to City Development and $400,000 to the Bookmobile, to name a few. All these things might be wonderful, but it’s hard to argue that they take priority over the safety of your family.

TIDs

Another large portion of the debt is from Tax Incremental Financing districts (TIDs). The City designates special areas where it funds speculative projects using credit. Using future taxes from that new development, the debt is paid back over the course of approx 30 years. These districts don’t create tax revenue for the City, because the tax money goes back to the debt created by the formation of the TID. Yet they require more services like police and fire.

Kenosha has 28 TID districts, the highest percentage of designated property in the State.6 The City sacrifices 29% of its revenue to tax abatements and these economic development subsidies.7 Some TIDs include luxury apartments, an art gallery, community theater, a boutique hotel, Amazon, Uline, Rustoleum, 4 gas stations, the failed Pick n Save on 63rd, and new projects like “Downtown Vision” and the Kenosha Innovation Neighborhood. These are all projects that citizens have not been asking for, yet the City does them anyway in the name of growth. Meanwhile, we can’t afford police that the people are asking for.

It’s been difficult to piece together the numbers for TID project expenses. The budget records only tax increments, and there’s no indication of how much total money each TID has spent or exactly what the money’s for. Adding to the complexity, funds can be transferred from one TID to another, and more debt can be created over the course of a TID’s lifetime. That could potentially hide spending that many taxpayers would disagree with – like subsidies to corporations. It’s common for municipalities to offer grants or forgivable loans to private companies for building in a TID.

TIDs are touted as a way to grow the tax base and eventually lower taxes when they’re closed. But as in many cities, that speculative revenue hasn’t materialized. And a TID can still cause taxes to go up during its lifetime, and even after closing it.8 Another downfall of TIDs is inflation. Tax revenues are frozen for nearly 30 years, so the value of that money decreases over time (by 9% this year!). To compensate for the lost value, cities have to raise taxes or cut back on services. Government “development” is gambling. And often a bad bet.

Postcard

You may have seen postcards from the City recently, urging you to vote “YES” on the referendum. The total cost is $28,000 and was apparently budgeted for last fall. The postcard included many affirming quotes from what can be considered partisan unions and special interest groups. The postcard had no disclaimer. The purpose is being portrayed as “community education”, but I have trouble agreeing when the postcard explicitly says to vote “Yes”. That is typically the definition for propaganda.

In 2018, the city passed a nearly identical referendum for 5 police and 2 firefighters. But the postcard says our Fire Department hasn’t added any personnel in the last 20 years. I inquired about this discrepancy and was told that we did add 2 firefighters but then subsequently removed them, resulting in maintaining the original number. Even if that’s the case, the postcard is still quite deceiving.

It doesn’t seem ethical or legal for elected officials or administrators to be using the perks of the office and money from taxpayers to influence elections and tell taxpayers how to vote.9 The City is spending $28,000 for questionable postcards to gaslight us into believing that homeowners need to foot the bill for the City’s poor budgeting and pet projects which result in the “growth” that is the very impetus for an increase in staff.

Conclusion

First we are taxed to pay for investments. Next, we’re taxed because the preexisting services have subsequently become strained by businesses whose presence we subsidize. And finally we are being taxed again on postcards to influence us to be convinced that we should allow ourselves to be taxed even further.

If taxes were just raised 4 years ago with the same referendum, are we to expect another raise in 2026? By attempting to raise taxes, the City is shirking its responsibility to balance its budget. Voting “No” on raising taxes doesn’t mean we can’t fund public safety. Ask our mayor and council to consider a better option: Balance our budget and protect our families at the same time.

_____________________________________

- The following question will be on the Aug 9th ballot: “Under state law, the increase in the levy of the City of Kenosha for the tax to be imposed for the next fiscal year, 2023, is limited to 2.654%, which results in a levy of $75,763,738. Shall the City of Kenosha be allowed to exceed this limit and increase the levy for the next fiscal year, 2023, for purpose of additional police and fire protection services, by a total of 3.3%, which results in a levy of $78,263,738, and on an ongoing basis, include the increase of $2,500,000 for each fiscal year going forward?”

- This referendum proposal was sent through the Finance Committee. Proposals must pass at a committee level before they proceed to a full council vote. Most committees, such as Public Safety and Welfare, meet every other week. The full council meets on the opposite weeks. That usually provides a week in between the first time a topic is heard at committee, to when the council casts the final vote. However, the Finance committee meets on the same day, a half-hour before the council meeting, so there was nearly no ability to deliberate, especially being one of 4 brand new council members.

- See page 283 of Kenosha’s 2022 Operating Budget.

- See page 55 of Kenosha’s 2022 Operating Budget.

- The latest S&P Bond Rating report states that Kenosha’s “economic measures lag those of similarly rated peers and its growth has contributed to a high direct debt burden.”

- California was the first state to adopt a TIF program in 1952. Wisconsin followed suit in 1975, but now has more TIDs than most other states. Since then, Kenosha created a total of 33, and only 5 have ever been retired. Only a handful of districts were started without Antaramian as acting mayor, and a large number were created in just the last few years. This could be attributed to Antaramian proposing and contributing to many WI State TIF laws over the years, including those that loosened restrictions.

- Kenosha ranks #10 for US cities reporting the largest losses from tax abatements. See https://www.governing.com/archive/local-tax-incentives-subsidies-income-inequality-report.html

- New TID construction can increase the City’s overall levy limit, meaning taxes will go up during the lifetime of the TID. On top of that, when a TID is terminated, state law allows a 50% increase in the base levy of the tax increment, for a total increase of 150%.

- Kenosha’s General Ordinance code 30.06 prohibits the use of City equipment or work time to participate in a political campaign. The Federal Hatch Act also restricts the political activity of local employees. A referendum question is inherently political (note I did not say partisan), because it’s a Yes or No vote and some individuals will see the issue one way and others will see it another way. But even if a specific law hasn’t been broken, it seems quite unethical. Those who hold a differing opinion don’t have the ability to use City funds to promote a No vote, and probably can’t do it themselves because $28k is a very large sum of money.

*The opinions and beliefs expressed in this article are mine and do not reflect the opinions and beliefs of the City.

36 Responses

This article was very informative. It is not surprising that Alderman Mau is unpopular with the other dolts on the city council.

I would be interested in just how much the city spends on litigation. It is constantly being taken to court. That has been the case for decades. Corruption is a big expense for the taxpayers. Citizens need to wake up and address this in order to reduce the corruption tax. That money could then be spent on new officers and firefighters.

Alderman Mau is right. If the city gets a grip on its expenses, this tax increase could be avoided.

Very informative indeed. This sounds like the only person on the council with half a brain. 16 liberals and one conservative ? We are doomed. Please “vote no!”

I am voting no. I have to stay within my families budget, Mr. Mayor stop spending our money on your pet projects and balance your budget.

So what is your answer other than voting no. The population has grown in not just Kenosha, but the surrounding communities. That means increased traffic, increased crime, increased need for services. The need is there for additional police and fire. Yet you offer no real solutions to expand those needed services. What’s your plan? What do you propose? How would you balance the budget? It’s easy to be in the minority, it’s easy to bitch and complain about the mayor and debt. The hard thing to do is offer real solutions, which you have failed to do. I’m starting to regret my vote for you Ald. Mau.

Thank you for your feedback. I did my best to bring light to an issue that many of my constituents are concerned about. There are 2 proposed alternatives in this article: balancing the budget and limiting the duration of the tax increase. I’d be more than happy to hear any solutions or other input you might have as well. Email me anytime at district8@kenosha.org

Isn’t it illegal for the municipality to ask voters to vote for or against a referendum?

Possibly. See footnote 9

Ald. Mau’s article is interesting and, to some extent, informative. What it isn’t is the truth, the WHOLE truth and nothing but the truth. Period.

But before you set out to tar and feather the poor guy remember that he can’t tell you the truth, the WHOLE truth and nothing but the truth because he’s a politician and if he did it’s the political kiss of death. And the lack of competence, integrity, candor and stewardship in fiscal matters is not exclusive to any one particular political persuasion. They ALL do it so you can take your conservative vs. liberal shit and sick it up your ass.

I worked with budgets for over 40 years. I will tell you the TRUTH. You may not like it. None of us does. Who wants to pay more taxes? Who wants to pay more for gas, milk, bread and almost everything else under the sun? Try going into Wal-Mart or Kwik Trip and see how far you get pissing and moaning like a bunch of ignorant jackasses.

Here’s the truth about municipal taxes. Your city is a lot like your condo association. Every year the condo association figures out how much they figure will be needed to pay for repairs, maintenance, replacing aging roofs, etc. (And, yes, they do prioritize.) But basically what they do is figure out this number and divide it among the condo owners which is your monthly association fee. Municipal taxes are much like that: figuring out how much is needed and then passing the hat.

Yes, I simplified it for sake of comparison. The city gets money from a lot of sources including property tax revenue, state and federal aid and shared revenues. Like any other consumer the city pays more for gasoline, copy paper, vehicles, parts and repairs and so on. And yes, cities do prioritize. That in part is what your capital improvement budget is all about: a schedule of planned maintenance. There are also unplanned expenses, like a riot.

The problem is that politicians play politics with this stuff and they wind up costing taxpayers more yet they are rarely held accountable for mismanagement.

The Kenosha County Board is a prime example of mismanagement for political sake. How so? Let me put it in simple terms.

Suppose you go to the dentist and you’re told you have a chipped tooth with a big cavity and it needs to be filled. But what happens when you don’t spend $200 for that filling? It turns into a $2,000 crown (maybe more with a root canal) and it’s an emergency expense that guts your budget.

The county board (and other politicians) kiss up to voters touting how they “held the line on taxes and spending” while simultaneously concealing their costly mismanagement. Then when taxpayers get hit with a whammy they duck, hide and blame someone else.

Madison? It’s an art form there. Nearly 50 years ago Gov. Pat Lucey, a Democrat, glorified his “no tax increase” budget. Yes, no STATE tax increase, but there are a slew of increased user fees and deep cuts to state aid, shared revenue and other programs that counties, municipalities and school districts had to make up via the property tax.

Acting Gov. Marty Schreiber, a Democrat, left office with a budget surplus. His successor, Lee Dreyfus, a Republican, campaigned on giving back the surplus. Instead of setting money aside for a rainy day (as we all should so) Democrats teamed up with Republicans to give the money back (I remember my big ole $40 rebate check — BFD). As Governor Dreyfus was leaving office in 1982 the state’s economic fortunes turned and there was no rainy day fund left.

Tony Earl, a Democrat, pushed through a temporary income tax surcharge (passing the hat) that was ended ahead of schedule when the state’s books were in better shape. Tommy Thompson campaigned against “Tony the Taxer” and had a good fiscal era until the latter days of his term which left his successor, Acting Gov. Scott McCallum, in the hole. And this web of deception and mismanagement recycles self every couple of years.

A few years ago the legislature not only cut state aids but capped the ability of municipalities, counties and school districts to make up the difference unless voters approve a property tax increase. That’s the boat the City of Kenosha is in.

Now before you freak out at the legislature that did this you have to take into account the city’s own financial mismanagement. The city went on an annexation spree, extending city limits west of I-94 without having the funding to support the increased services necessitated by this growth. They were warned about it then but now it’s time to pay the piper. Of course they won’t tell you the WHOLE truth about this.

Part of the problem is levy limits, sure. But part of it was biting off more than the city could afford to chew and now taxpayers are being hit up for this colossal fiscal phuckup. (Yes, it’s the $2,000 crown again!)

Ever the balding bastion of buffoonery Ald. May buffalos you with his bellyaching about museums, libraries and the Trolley. He’s not alone in deflecting blame, of course. And he’s not the only one preaching ignorance.

In business — and to a large extent government is a business — you have to spend money to make money. It is illegal to police for profit. A good fire department helps your property insurance bill.

How many Target stores have you been in that don’t have clean bathrooms? Or a dirty Culver’s with employees waiting on you who don’t give a rat’s ass about their job? Yes, they have to spend a bit more but guess what? People come in because it’s clean and friendly.

People come to Kenosha to visit the museums, the marina, Harbor Market and ride the trolley which isn’t a means of transportation as much as it is a tourist attraction. And what do tourists do? They eat, shop and spend money that turns around in the community. Parks, good streets and civic amenities help attract higher income residents who not only spend money in the community but pay more in taxes! And what do those taxes help support? The public safety services that in signficant measure are utilized by the less contributing members of the society who are more tax-eaters than taxpayers. (Marion Berry, a controversial mayor of Washington, D.C., often caught Hell from some constituents about the amenities extended to third ward residents. Mayor Berry would shoot back that the money made there paid for services in the less well-heeled parts of town.)

The truth isn’t convenient for many politicians but it would be refreshing to hear it more often instead of bloviating baloney from politicians experiencing rectal-cranial inversion.

And yes, Ald. Mau is well within his rights to complain about the referendum and the city’s p.r. campaign but he should tell the truth about what’s really wrong: habitual fiscal mismanagement and deception and boneheaded myopic decisions by state and local politicians.

One of the other issues is the amount of city reserves which affects bond ratings. It’s not as simplistic as the amount of debt but Mr. Mau is not off the wall for being concerned about debt. Some of his comments are myopic and don’t see the overall picture but despite that there are some valid concerns. The city expanded borders without the resources to handle it. The city must do more to be attractive to business and contributing residents, not less.

Why do TIDs work in Pleasant Prairie and not in Kenosha?

They just raised taxes with the same referendum too.

Nothing is the truth in Pleasant Prairie they lie from board president on down including finance director!

If residents want public safety they better not vote for another dead beat sheriff and another dead beat mayor when the time comes. A sheriff and mayor that doesn’t allow your city to burn will save you tax $$ if they actually do their jobs while giving you that sense of security you deserve. Get smart Kenosha residents, your city has turned into a democratic shit hole like every other Democratic controlled city in the US and you have no one to blame but yourselves for voting for these degenerates every election season. Kenosha is reaping what it has sowed.

Dave Mau – thank you for taking the time and effort to write this informative piece. I sure wish you were my alderman!

Mr. Mau

You are wrong on so many levels I do not know where to start. I will try to be succinct. You are trying to apply a micro solution to a macro concern. You are trying to apply a short term fix to a long term management issue.

The State has put unreasonable restrictions on municipalities.

Long term debt builds your roads and buys to equipment to maintain them. Other projects cannot be funded without long-term debt.

Public safety needs to be number 1 and law enforcement has been understaffed for many, many years.

I appreciate your feedback. You mention “trying to apply a short term fix to a long term management issue.” I believe the referendum is the short term fix, and balancing the budget is more long-term sustainable. My article is critical of long term management. I ran on fixing roads. Not all debt is bad, but 17% is. I also agree that public safety is the #1 priority. Can you clarify where we disagree?

You are in the newspaper today. I agree and disagree. Actually, increasing population is more expenditure intensive. Home have kids and that means more schools. Industrial parks don’t have the same personnel costs. What you should have said is that annexations are to blame.

Ald. Mau is a breath of fresh air regarding and against Kenosha’s ongoing “progressive” tax increases. Both the Police Department and Fire Department have unfilled positions and now want to raise taxes for the working poor to pay for unneeded positions. The increase of tax money may be added to the public safety budget, but is usually withdrawn and spent for other things. If the referendum is a way for Kenosha to get more money for pay raises, be clear and tell the taxpayers the truth. Taxes need to be reduced by 10% or more so the families have more money to pay their family expenses, like groceries and rent.

I feel your pain but your city, village, town, county and state are consumers as well. Price increases affect them as well.

Vote ?

Kenosha needs a sweep of diminished Alderman!

Mr. Faux Conservative Public Safety First is in the hip pocket of the marijuana industry. We have enough addiction in this community and he wants to add more, ignoring the costs in dollars and lives. We have too many drunks on the roads and now he’s enabling stoners?

Clowns on the left and now tokers on the right. Yikes!

It might be a serious comment but it is funny

Touche.

Now?????

Marijuana has been here a long time. Clearly you are clueless to the realities of pot.

Lots of it already being grown in Kenosha county.

And Id rather drive on a road with someone who has smoked two joints as opposed to the drunk that downed a six pack.

Learn something….

Both are dangerous

Sheesh

HMMMM…let’s see…would I want my granddaughter run over slowly (smoking pot) or fast (drunk driving). SMH!!!

I think this same anonymous guy posting over and over and talking to himself. You can see his writing style.

Debt per person in Wisconsin

Appleton: $457.42* per person

Janesville: $1,168.71

Green Bay: $1,295.47

Racine: $1,374.35

Eau Claire: $1,377.91

Kenosha: $1,391.71

Waukesha: $1,638.06

La Crosse: $1,723.49

Oshkosh: $2,078.54

Average: $1,389.52

*Note: Appleton’s debt per person would increase to $869.45

with $30 million in bonding for a new library.

Kenosha’s debt is about average for the state. Oshkosh is way above and we should find out how Appleton, a nice town, does it.

Just so you are aware, these numbers are from 2014. As of 2022, it’s approx $2,250.

What’s the state average?

Ald. Mau has some interesting data. Wisconsin Policy Forum says Kenosha spends a little over 56% of its budget already on public safety while the state average is a little over 39%. Already. And they want more???

Agree in part with the alderman. City has a big % of funding now for safety. Here’s what the Wisconsin Policy Forum says about debt: “State limits on local tax levies have substantially reduced the property tax burden in Wisconsin, which was the primary objective of lawmakers who adopted municipal and county limits in 2005 and who have maintained strict revenue limits for school districts in recent years. The new state budget’s freeze on school district revenue limits and continuation of the existing limits for municipalities and counties promises to maintain that same trajectory. As a result, if local officials feel they need to increase property taxes to maintain or expand services, they may need to seek voter approval or issue greater amounts of municipal and county debt.”

The reason debt shot up is levy limits.

Blame political smoke and mirrors in Madison and city hall incompetence.

The legislature cut state aid to municipalities and then imposed levy limits which require a referendum to exceed but they excluded debt service. Municipalities borrowed more. At the end of the days the bills have to be paid one way or the other. The legislature has been doing this cost shifting for years. Kenosha Common Council approved expansions without the money to pay for them.

I’m not a fan of this referendum. I don’t think other city services need to be cut as the inexperienced alderman suggested. I do think city hall could be more creative and open minded about how services are provided. One possibility is consolidating fire protection and EMS into a regional fire department — Kenosha, Pleasant Prairie, Somers and maybe Bristol. Has there been a management study of the Kenosha Police Department? Could some administrator positions be combined or eliminated? Could administrative officers handle paperwork while sworn officers patrol? Could retired officers be hired part-time to handle station house duties? Before supporting a referendum I think all options need to be explored.

Continuing my earlier post. There is a public information officer lieutenant. Does this need to be a sworn supervisory position? Could it be done by a non-sworn officer as in other cities. Again, recently retired officers (there are lots of them) could be a talent pool. Same for planning and training positions. Some detective work could be done the same way. Many years ago there was a police cadet program, too. What I see here is a lot of “we’ve always done it this way.”

I wish this guy was my alderman. It seems he knows what he’s talking about and hasn’t been compromised to look the other way while the city treasury is being looted and basic services wither on the vine.